-

Muhammad Adnan

- January 26, 2024

Financial Software Development Step by Step Guide

Financial software development is the best solution these days for most of the fintech firms. Do you know most of the firms are struggling with a variety of security vulnerabilities? Moreover, they are lacking with the satisfactory user-interface, and with the transparency issues. Therefore, to get rid of the issues, financial firms have to bring technological solutions in place. Today, in this guide we will discuss all of that. Moreover, we guide you about the necessities of Fintech software, particular features, and all the stages involved in the development process. Let’s redefine the importance of financial management in your fintech businesses.

We are fully aware of the fact that you being in the fintech business are dealing with a variety of challenges. The complexity of the industry is one of the reasons behind it. So, in this situation, fintech software development solutions come in handy. Financial software applications have made the fintech business cover all the issues starting from zero barrier apps to improved productivity.

Moreover, it has introduced automation in customer care, security issues, and many more. In this guide, you will also get to know how to maximize it to the next level. Suppose, you want to know about the latest fintech trends to follow. You don’t know where I should start. Moreover, you are trying crucial features in your fintech software and how would you make it possible. Read our step by step guide to financial software development.

Financial Software Development Statistics Fintech Firms Should Know

Before we briefly discuss about the financial software development following are latest statistics about the market that fintech businesses should know:

The total revenue of finance all across the globe is going to increase 11.32% which is approximately $2.38 billion in 2027. (CAGR 2022-2027)

Numbers are talking themselves. After setting these stats you may have interest in knowing how financial software development services can lead you to get more out of your Fintech firm. There is no doubt that it has become a game changer for financial businesses. It has become crucial to have fintech software solutions. It helps you to streamline your operations, enhance security, and to put customer support on automation with effortless user experience. In addition to that explore the crucial reasons behind investing in Financial Software development.

6 Reasons Fintech Firms Should Invest in Fintech Software Development

Do you know you can significantly benefit from your fintech company investing in enterprise software development services? It empowers you to get help boosting productivity, facilitating operations, and improving client satisfaction. You can customize the software by getting software development outsourcing services. It helps you in safe financial transactions, automation processes, and crucial information for well-informed decision-making.

One thing is to remember that fintech software significantly enhances your business productivity, and scalability to save time, and money.

Reason No#1: Digitalization of Cash

You know digital cash is changing the business landscape. Financial software development has become crucial. Businesses these days love to stay competitive and they have to invest in a financial software development company to develop for fintech software development.

It helps to make digital transactions error-free, and easy. Moreover, it has made it instant, and straightforward. A piece of fintech solution can do wonders for finance companies to take digital payments to boost client convenience and sales.

Digital cash makes us get rid of dealing with the hassle of physical cash. Financial software minimizes the errors, makes it easy to process, and automates it. It also provides improved security compared to physical cash.

So, we can say that financial software applications give businesses a peace of mind and put their cash dealing worries to rest. Likewise, it provides secure payment gateways, encryption, and fraud detection.

Reason No#2: Decrease Lower Service Expenses

- Businesses can instantly automate the process, like cutting down human labor. Moreover, decreases all the manual efforts through customized software solutions.

- It also helps lower overhead costs and enhance operational efficiency.

- Fintech Software or applications can streamline reporting, accounting, and transaction processing, and save money, and time.

- At the end of the day, all the service costs will be cut down and empower fintech firms to offer competitive pricing and engage customers to boost the overall revenue of the company.

Reason#3: Vast App Market

The most valuable reason for investing in financial software development is the massive app space. A typical fintech solution empowers your firm a significant advantage to consider mobile solutions that increase number of cell phone adoptions.

So, it empowers you to communicate with the clients in a pinch and help out to engage a large audience. Moreover, easy access to the fintech services. Therefore, get the benefits of the huge app market. It helps you to increase market penetration and helps you to stay ahead of the competition by investing in financial software development.

Reason#4: Limited Banks Visit

- Digital banking popularity rises, increasing online transactions and self-service options.

- Businesses enhance customer experience with sophisticated financial software.

- Clients can perform diverse banking tasks seamlessly from their devices.

- Time and resources saved for businesses and consumers.

- Improved customer convenience reduces the necessity for in-person bank visits.

- Small investment in custom financial software development enrolls clients in advanced solutions swiftly.

Reason#5: Importance of Financial Data & Its Security

Companies, like fintech firms and banks, are more likely to face several vulnerabilities. It could be about data safety. Moreover, the protection of sensitive information from online threats, and breaches are very crucial.

So, it has become crucial for financial business firms to invest in Fintech software development by implementing security measures such as encryption, secure data storage, and multi-factor authentication. Moreover, security of data storage to protect customers’ data from unauthorized access.

Reason#6: Penetration Testing on the Swift blockchain

Swift stands for The Society for Worldwide Interbank Financial Telecommunication, It is a network that financial organizations and banks utilize for crucial and secure communication. Swift incorporates blockchain technology that offers fintech application solutions and investments with various benefits.

Blockchain is a technology that provides security when it comes to financial transactions. It offers a decentralized ledger, numbers of parties record, performs transactions, and does not require any mediator. The best part is that it ensures the prevention of any fraud, or data breach. It also minimizes expenses.

What Are the Crucial Features of Financial Software Applications?

Secure Authentication

It ensures access to fintech data using 2FA techniques. Moreover, it prevents breaches, anonymous access, and implements biometric systems.

Model-Specific Functions

It is a feature for diverse fintech models. Further, enhance adaptability with industry-oriented tools to know about the risks, calculations, data analysis, and risk management.

Secure Payment Features

It provides money transferring without hassles, nd using different payment gateway. It includes digital wallets, and cryptocurrencies at a time of crucial data safety.

Insightful Dashboard

Centralises financial data and insights in a visually appealing interface, aiding in report creation, trend analysis, and informed decision-making for efficient financial management.

It helps financial software to categorize IT data and information via appealing interfaces. Moreover, it adds to the creation of a report, and decision-making for financial management.

Real-Time Alerts & Notifications:

Keeps users informed with real-time alerts for account changes, payment reminders, and security updates, delivered through email, SMS, push notifications, or in-app messaging.

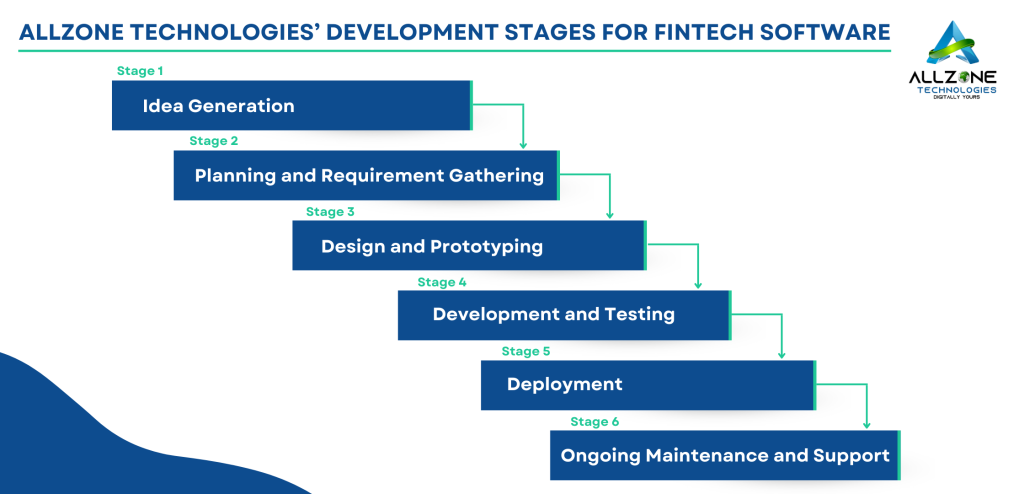

AllZone Technologies’ Development Stages for Fintech Software

Idea Generation:

Unveils creative concepts aligning with financial industry needs, ensuring a solid foundation through market study and stakeholder input.

Planning and Requirement Gathering:

Conducts comprehensive research, captures user expectations, and outlines development specifics, establishing the groundwork for successful financial software creation.

Design and Prototyping:

Visualizes user interface and experience, crafting interactive prototypes and wireframes to refine design, functionality, and user interaction for optimal user experience.

Development and Testing:

Implements code, constructs software modules, and conducts rigorous testing (static, unit, integration, and system) to address issues and ensure reliability and efficiency.

Deployment:

Rolls out the software to users, monitors performance, addresses issues, and provides updates to enhance functionality and security, ensuring a reliable user experience.

Ongoing Maintenance and Support:

Focuses on continuous functionality, addressing glitches, and offering user support through updates and patches, maintaining the financial software’s dependability and user satisfaction.

Frequently Asked Questions

Why is financial software development crucial for fintech firms?

Fintech companies could face vulnerabilities, like security issues, user-interface issues, and transparency concerns. Therefore, Financial software development services of companies, like AllZone Technologies provide tech solutions to prevent the issues, and challenges. Further, streamline operations, improve security, and automate customer care for your fintech businesses.

What are the Key statistics about the fintech software development market that fintech businesses should know?

The total revenue of the global finance market is projected to increase. Approximately it will boost to $2.38 billion with a Compound Annual Growth Rate (CAGR) of 11.32% from 2022 to 2027. Fintech application development has become a game changer for financial businesses, offering solutions to improve operations, security, and customer support.

What are the top reasons for fintech firms to invest in fintech software development?

Financial companies can get advantages from financial app development. It helps them to digitise the cash transactions. Moreover, it minimises the services expense using automation tech tools. Further, It can tap into huge markets, and reduce the need of physical banks’ visits. It secures the financial data as well.

What are the specific features of financial software applications that enhance security and functionality?

Financial apps provide numerous features, like secure authentication with 2FA. Moreover, offer model specific functions aligned with fintech models, and safeguard payment features for error-free and easy transactions. Also, offer insightful dashboards to centralise fintech data, and give you live alerts, and notifications.

What are the development stages involved in creating financial software?

AllZone Technologies’ development stages for financial software includes, idea generation, planning, design, prototyping, deployment, testing, and post development support. Our fintech software development experts provide a solid foundation, user-friendly interface, accelerated functionality, and on-going improvements in fintech apps.